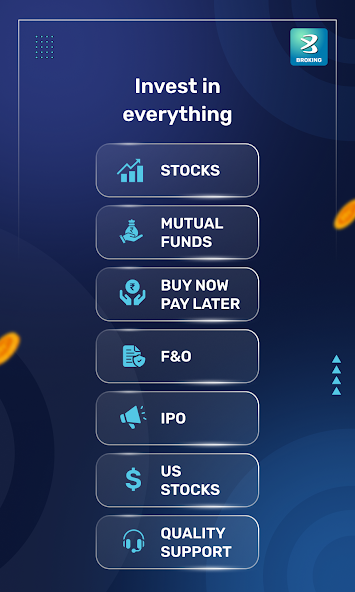

Building wealth in today’s financial environment requires informed planning, patience, and disciplined allocation of assets. A well-structured Mutual Fund Portfolio allows investors to participate in market growth while managing risk in a balanced manner. With easier access to investment tools and data through a Mobile Trading App, individuals can track, review, and adjust their Mutual Fund Portfolio more efficiently than ever before.

Selecting the right Mutual Fund Portfolio is not about chasing short-term performance. It is about aligning investments with financial goals, time horizon, and risk tolerance. This explains how to approach portfolio selection in a structured way to support steady asset growth over time.

Understanding the Concept of a Mutual Fund Portfolio

A Mutual Fund Portfolio refers to a collection of mutual fund schemes selected to meet specific financial objectives. Instead of relying on a single investment category, a portfolio spreads capital across different asset classes and strategies. This approach helps reduce concentration risk and improves consistency in returns.

Each fund within a Mutual Fund Portfolio serves a purpose. Some provide growth potential, while others offer stability or income support. When managed properly, the portfolio works as a unified structure rather than a set of independent investments.

Importance of Portfolio-Based Investing

Portfolio-based investing focuses on balance rather than isolated performance. Market conditions change over time, and asset classes respond differently to economic cycles. A thoughtfully constructed Mutual Fund Portfolio adjusts to these changes by distributing exposure across segments.

Using a Mobile Trading App allows investors to review holdings, monitor allocation, and track performance without complexity. However, tools alone cannot replace planning. The foundation of portfolio success lies in selecting funds based on structure, not trends.

Key Factors to Consider Before Portfolio Selection

Financial Goals and Time Horizon

Before selecting funds, investors must clearly define their objectives. Short-term goals require different portfolio structures than long-term wealth accumulation. Time horizon determines how much risk a Mutual Fund Portfolio can reasonably absorb.

Longer investment periods allow for higher exposure to growth-oriented funds, while shorter timelines call for more conservative allocation.

Risk Tolerance Assessment

Risk tolerance varies from one investor to another. A Mutual Fund Portfolio should reflect the investor’s comfort with market fluctuations. Overexposure to risk can cause emotional decision-making, while excessive conservatism may limit growth.

Balanced allocation ensures that returns are not dependent on a single market movement.

Asset Allocation in a Mutual Fund Portfolio

Asset allocation is the core structure of portfolio selection. It defines how investments are distributed across categories such as equity-oriented funds, debt-focused funds, and hybrid options.

Equity-Oriented Allocation

Equity-focused funds aim for capital growth over the long term. They are suitable for investors with longer time horizons and the ability to withstand market volatility. Equity allocation provides the growth engine of a Mutual Fund Portfolio.

Debt-Oriented Allocation

Debt funds contribute stability and income consistency. They help reduce overall portfolio volatility and are especially useful during uncertain market conditions. Debt allocation supports capital preservation while generating predictable returns.

Hybrid Allocation Approach

Hybrid funds combine equity and debt exposure within a single structure. Including them in a Mutual Fund Portfolio can simplify allocation while maintaining balance between growth and stability.

Role of Diversification in Portfolio Stability

Diversification is essential for reducing dependency on any single market segment. A well-diversified Mutual Fund Portfolio includes exposure across sectors, investment styles, and asset categories.

Diversification does not mean excessive complexity. It means selecting funds that complement each other. When one segment underperforms, another may offer support, helping maintain portfolio consistency.

Monitoring and Reviewing Portfolio Performance

Portfolio selection is not a one-time activity. Regular review ensures that the Mutual Fund Portfolio remains aligned with financial goals. Changes in income, expenses, or life priorities may require adjustment.

A Mobile Trading App helps investors monitor performance, review asset allocation, and assess whether rebalancing is needed. However, frequent changes should be avoided unless there is a clear structural reason.

Rebalancing for Long-Term Consistency

Rebalancing involves adjusting portfolio allocation to maintain the original investment structure. Over time, certain funds may grow faster and disrupt the intended balance.

Rebalancing restores alignment without increasing risk unnecessarily. It supports disciplined investing and prevents overexposure to a single asset category within the Mutual Fund Portfolio.

Common Mistakes to Avoid in Portfolio Selection

Overlapping Investments

Selecting multiple funds with similar strategies can lead to duplication. This reduces diversification benefits and complicates performance evaluation.

Ignoring Cost Structure

Expense ratios and exit conditions affect long-term returns. A Mutual Fund Portfolio should be cost-efficient without compromising structural balance.

Reactive Decision-Making

Market fluctuations are normal. Reacting emotionally to short-term changes often harms portfolio stability. A structured approach helps maintain consistency during market cycles.

Long-Term Discipline and Portfolio Growth

Long-term success depends more on discipline than prediction. Staying invested through market phases allows compounding to work effectively. A well-planned Mutual Fund Portfolio benefits from time, patience, and systematic contribution.

Using a Mobile Trading App simplifies tracking, but discipline comes from understanding the portfolio’s purpose rather than reacting to daily movements.

Conclusion

A carefully selected Mutual Fund Portfolio supports smart asset growth by balancing risk, diversification, and long-term planning. When aligned with financial goals and reviewed periodically, it becomes a reliable framework for wealth creation.

Access to investment tools through a Mobile Trading App makes monitoring easier, but success depends on structure, not speed. By focusing on asset allocation, diversification, and disciplined review, investors can maintain a Mutual Fund Portfolio that adapts to market changes while supporting steady financial progress.

Choosing the right Mutual Fund Portfolio is a process, not an event. With informed decisions and consistent strategy, smart asset growth becomes an achievable long-term outcome.

Recent Comments